Vision Real Estate Methodology Acquisition Criteria

Acquisition Criteria

As an entrepreneurial owner with an institutional pedigree, we partner with national and global institutions – and private equity – to pursue value-add, opportunistic, select core and core+ investments across the office, industrial, flex, mixed-use and retail sectors. This includes both existing assets and development/redevelopment sites. Our diversified capital structure affords the ability to target risk-adjusted returns based on investment opportunity and product type.

Value creation is our culture at Vision Real Estate Partners. Our firm’s investments must meet strict benchmarks for asset class, market (historical, current, projected), location, capital commitment, functionality, leaseability, and operational capability (both near and long-term). We select our projects solely on sound real estate fundamentals. Opportunities are never financially engineered to justify an acquisition. Value creation is an assembly line that begins with the raw material, including:

High-Quality Core Assets with Risk Adjusted Returns

Value is created through high occupancy, excellent quality operations, financial management and smart capital plans to maximize long-term values,

Redevelopment Opportunities

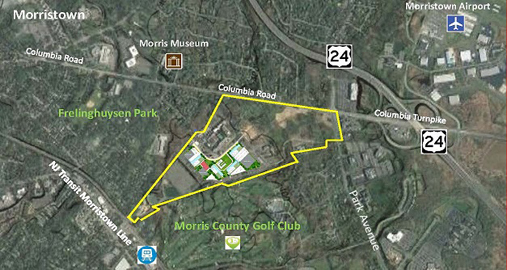

Value is created through acquisition of well located, underutilized assets in fundamentally sound, in-fill locations. VREP obtains approvals for redevelopment, with appropriate capital expenditures, to achieve maximum rental rates on a time-sensitive basis. VREP’s redevelopment projects have been historically sought by demanding and intuitive corporate users because our assets outperform the quality/value equation achievable in the marketplace.Development/Land Entitlement Sites

Value is created through seeking out and obtaining unapproved land parcels and obtaining as-of-right or achievable change-of-use approvals. Predicated on market conditions, VREP maximizes value through above market sale of the fully entitled asset or develops the entire project including lease-up and operations through stabilization and ultimate financing and sale of the asset. VREP’s historical market knowledge and technical expertise allows for sites to be identified and approvals obtained on a timely basis through effective management of development, political, environmental, legal, and design/engineering and constructability issues.